How many mines does it take to...

Round-up of the mining news around the world that companies tie to climate efforts

Climate technologies require enormous amounts of metal. I’m Ian Morse, and this is Green Rocks, a newsletter that doesn’t want dirty mining to ruin clean energy.

Two major pillars in the ‘transition minerals’ sphere have recently tallied the number of mines they believe to be required to meet forecasted battery demand. Do battery companies need 10 more lithium mines or 50? Crucially, Benchmark Minerals Intelligence and the International Energy Agency offer answers that differ pretty widely.

As you’d expect, the estimates depend mostly on how you forecast demand and how large your mines are. Who determines how high demand reaches? How do you distinguish between climate demands and company desires? Are your metal sourced from large-scale mines, community-level mines, dispersed mines, urban e-waste mines, or other recycled materials? What’s the goal? There’s not many answers to these questions.

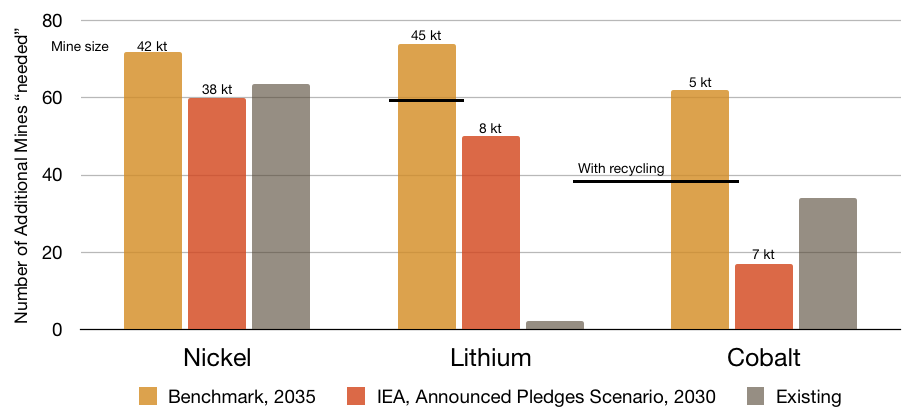

I’ve created a little chart comparing the two predictions. It illustrates a few of the most unclear points. How can the IEA assume a smaller size of a lithium mine at the same time it predicts fewer required lithium mines? The IEA based their targets on announced country pledges to reduce emissions. Both IEA and BMI describe their lithium mine sizes as “average”. I’ve asked Benchmark how they’ve calculated their battery demand, which seems to require many more materials, perhaps because it forecasts until 2035. Both include EV and non-EV demand.

Then, it’s helpful to put this in the context of existing production capacity. Using USGS stats of annual production in 2021 and Benchmark’s “average mine size”, we can infer how many mines (or Benchmark-mine-equivalents) may already exist.

These mines, BMI says, should be built to address battery demand by 2035. At the same time, the IEA acknowledges that mines take from 5 to 20 years to come to production. Hence US politicians’ and companies’ push to ease permitting, and the European Union’s push to find alternative sources, and Chinese companies’ globe-trotting for minerals and domestic recycling efforts. The Economist says people need to clear the way for companies to produce, and give them more money.

Climate Goes Metal news

[above] An AP investigation reveals the sites, actors, and communities impacted in China’s dependence on Myanmar for rare earth elements.

A Toronto-based rare earths processor bought permits to explore minerals in Greenland. It’s one of the only processors outside China.

Chinese battery giant CATL announced plans to build Europe’s largest battery factory in Hungary.

Executives of the company that employed eight zinc mine workers who died in a mine accident in Burkina Faso have been sentenced for involuntary manslaughter.

Researchers found that industrial mining indirectly caused the loss of more than 3,000 km2 of tropical forests. Eighty percent of the loss occurred in Indonesia (over 50%, mostly coal), Brazil (mostly iron ore and gold), Ghana and Suriname.

Stock markets cheered after Chile’s voters said ‘no’ to the first draft of a new, progressive constitution.

Chile’s finance minister introduced tax breaks and public investment to boost copper production.

Three miners died at a 68-year-old copper and zinc mine in Peru.

A worker died at an Ivanhoe-Zijin copper project in the Democratic Republic of Congo.

Tesla is applying for tax breaks for a lithium hydroxide plant in Texas.

A local community blockaded a gold miner in Mexico for several says last week.

Lawyers have filed a complaint against Glencore alleging it misled investors about its climate strategy while expanding its coal business.

Vale Indonesia has signed two almost-$2-billion deals to build nickel processing plants on Sulawesi in Indonesia, with Huayou and Shandong Xinhai.

Colombia’s new government is likely to begin requiring environmental licenses for exploration activities.

Mexico plans to set up a state-run lithium company after it nationalized reserves, and is now courting private investment.

Chile-based Antofagasta sued the US government for its revocation of permits granted to the Twin Metals project in Minnesota.

Volkswagen and Mercedes-Benz are looking to Canada for nickel and cobalt.

US politicians are getting in on the country’s swing toward battery metal companies.

The ISA, which regulates deep-sea mining, green-lighted preliminary extraction activities for a The Metals Company subsidiary.

A New York Times investigation details a 15-year, close relationship between regulator (ISA) and company (TMC) that resulted in the ISA granting TMC access to confidential materials.

Rio Tinto cut out a Russian firm from a Canada aluminum deal because it said it would have violated sanctions against Russian oligarchs.

Dozens of companies have announced accelerated plans after the signing of the climate-focused IRA bill in the US.

The Wafi-Golpu copper-gold project earned an endorsement from a new governor in Papua New Guinea, likely clearing the way toward permitting and beginning operations.

Environmental groups in Ghana are demanding the government make the Atiwa Forest a national park in the face of plans to mine it for bauxite.

A World Bank internal watchdog warns that a IFC-funded Chinese zinc and lead mine in Indonesia would pose a high risk of disaster to communities and ecosystems.

Reads

≠endorsement

‘We borrow our lands from our children’: Sami say they are paying for Sweden going green (The Guardian)

Uranium Risks Becoming the Next Critical Minerals Crisis (Bloomberg)

Climate bill would create roadblock for full EV tax credit (E&E News)

How and Why China Is Centralizing Its Billion-Ton Iron Ore Trade (Bloomberg)

Why golf carts—golf carts!—are a transportation mode of the future. (Slate)

The Security–Sustainability Nexus: Lithium Onshoring in the Global North (Thea Riofrancos)

The Race for US Lithium Hinges on a Fight Over a Nevada Mine (Bloomberg)

The shift to electric vehicles is about to overwhelm meager US mining operations (The Verge)

The next big battery material squeeze is old batteries (Bloomberg)

Electric car battery bottlenecks have a way of being worked out (Bloomberg)

Can Indonesia’s electric car, battery sector have a smooth ride beyond China? (South China Morning Post)

Indonesia’s high-carbon nickel key challenge in global EV uptake (Financial Times)

Deep-Sea Riches: Mining a Remote Ecosystem (The New York Times)