Could vanadium bring the stability we need?

Like other metals, it's getting a boost. But long-lasting, recyclable batteries have the potential to end up in a more sustainable market.

Climate technologies require enormous amounts of metal. I’m Ian Morse, and this is Green Rocks, a newsletter that doesn’t want dirty mining to ruin clean energy.

It’s 2030. US emissions have shrunk by half. The EU has gone even further. China, where the first two blocs get many of their products, still has a ways to go. Poor countries, burdened by debt to rich countries, haven’t been able to make up much ground.

Your energy likely comes from renewable sources like wind turbines and solar power. When there’s no wind or sun, the electricity you use to read the 10th Anniversary Edition of Green Rocks comes from batteries. Very big batteries.

Many of these grid-level batteries will likely be lithium-ion batteries. Some, and by a slight chance most, could be vanadium batteries.

In this edition, we’re going to figure out what’s happening with vanadium: where it is, where it’s going, who is pushing it and what roadblocks they are facing. Vanadium is a great example of how people think about metals as they confront climate crisis.

Marketeers say vanadium batteries are too expensive, but they last much longer than their lithium-ion cousins ever can, and they are currently much more recyclable. Vanadium miners are gearing up for a boom — including one that the US has fast-tracked for permitting — altering their image from a historical focus on steel to one centered on clean energy tech. And like other minerals, some of it is tied up with the fate of uranium.

Henry Ford has been credited with making vanadium popular. He began to use it in the steel that formed the iconic Model T. Decades later, one of Australia’s first female professors in chemical engineering invented the vanadium redox flow battery, which some call vanadium battery.

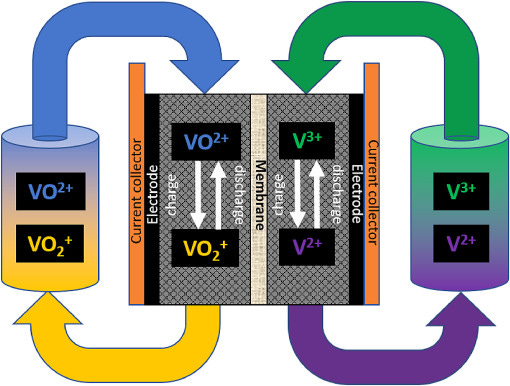

Why are vanadium batteries different? Well, this one flows. Lithium-ion batteries (LiBs) are blocks of metal that let lithium atoms jump between two electrodes. Vanadium batteries release their stored energy by sending a liquid vanadium electrolyte through an electrode membrane.

That grants it a lot of physical flexibility. So if we need big batteries, we just need more liquid electrolyte, rather than more giant batteries. At night, there’s no sun, but lots of liquid electrolyte can keep energy flowing for several hours. LiBs may need much more material to deliver the same capacity. Additionally, unlike lithium-ion batteries, there’s no risk that these will catch fire. Vanadium is also more abundant on earth’s surface than many of the elements that go into LiBs.

Vanadium and lithium-ion are competing for the lowest cost grid storage. Vanadium batteries have to deal with an expensive electrolyte. LiBs also need costly components but require more costly safety measures and degrade much more rapidly. Vanadium batteries don’t lose capacity over time. In theory, the membrane could last 20 years, at which point the electrolyte can be almost entirely recycled.

This is why recent research is telling us that the cost of vanadium batteries has already surpassed lithium-ion in some cases. Right now, some solar and wind farms are producing more than is needed. Instead of storing it in batteries, it’s simply being rejected from the grid. Grid storage will be expensive and metal-heavy whichever way you look at it. (In some locations, natural hydropower storage can be a clean option, and scientists are looking at many other innovative options that would likely be produced only for specific locations.)

But vanadium batteries have lagged significantly behind LiBs from grid-scale. Some have pointed to price, and others to the lack of manufacturing. There’s simply more factories producing LiBs right now. The most prominent companies in the vanadium batteries world have made just a few hundred installations. There is, however, a vanadium battery installation just an hour from where I live in Seattle.

I document in this newsletter the rapid expansion of mining as a result of the clean energy push. Lithium, cobalt, and nickel are the most cited ones. There’s also aluminum and copper that are expected to grow even more. The World Bank predicted last year that climate tech alone would need at least double the current production of vanadium.

Vanadium’s climate push is younger than other metals. Vanadium batteries haven’t quite taken off yet, and the market hasn’t needed new mines yet. Australia, the US, and Scandinavia have projects that are collecting capital and making regular big announcements on discoveries and permitting. However, because people are iffy on vanadium batteries, the price of the metal hasn’t quite convinced these projects to go head-on into production.

That makes this moment a really interesting one. In the past few years, legacy producers like South Africa, China, and Russia, have been able to slightly increase production in order to meet increasing demand. In general, these established mines aren’t relying on batteries to justify their increased production.

Vanadium is not expanding entirely because of batteries. Most vanadium is used for reinforcing steel, aluminum and titanium in construction industries. Just 1% of the world’s vanadium has gone toward batteries. In the style of Henry Ford, more and more vanadium is used in cars. It can make steel stronger and lighter. Some have predicted that the vanadium content in those cars will likely increase, and may even double.

For new projects in Alaska, Utah, Nevada, Australia and Sweden, batteries are at the center of marketing schemes. Some of these companies have signed deals with steelmakers. Others plan to mine uranium at the same time.

One of those proposed mines lies in Nevada, and last year, the federal government expedited its review process. The Gibellini project could be the country’s first vanadium mine, and it will also extract uranium. The draft environmental impact survey is expected midway through this year.

The project, owned by Nevada Vanadium, plans to pump water from a nearby ranch, transport ten truckloads of sulfuric acid to produce one truckload of vanadium each day. The company says they have designed the project to avoid disturbing wildlife habitats, and federal agencies will oversee permitting for uranium management.

However, the nonprofit Center for Biological Diversity is “deeply concerned about the potential impacts of NVC’s proposed vanadium and uranium mine on sensitive wildlife species, migratory birds, vegetation, water quality, and frontline environmental justice communities.”

Uranium, the group wrote to the Bureau of Land Management which will oversee permitting, has waste and radiation issues that are particularly difficult to control. Impacts have fallen disproportionately on Native American communities, and the uranium produced here may end up at a mill that has already led to health and environmental problems.

Mining and processing vanadium itself is dangerous. Research has demonstrated that inhaling a common vanadium product can make workers more likely to develop cancer. Increasingly widespread production may end up spreading these risks to more people. Environments near vanadium mines have shown increased levels of the metal, potentially threatening ecosystems and water.

The vanadium battery industry is developing in a different way than LiBs. Recently, mining companies have begun making their own batteries. Typically miners send off their products for processing, and they are disconnected from the end products. (This has made it difficult to pin down the full scale of miners’ emissions.) The market to produce vanadium batteries, however, is relatively small compared to LiBs. Miners who are just entering the market have an easier time competing.

Consider a mine in the state of Bahia, Brazil. Its owner, Largo Resources based in Canada, launched a vanadium batteries company in Delaware. Batteries produced from that company have a clear source, and the mine has a clear purchaser. For people investigating mining industries, this kind of vertical integration ensures direct accountability and traceability. (Vertical integration is an increasingly popular move by climate tech companies, like Tesla.)

Scientists and companies long believed vanadium’s value came from its size. Vanadium’s proponents, however, have begun launching small-scale projects, even for individual households, just as LiBs have been used.

A battle between vanadium and LiBs is likely coming. The technological benefits will certainly help determine a “winner,” but environmental considerations can also play a role.